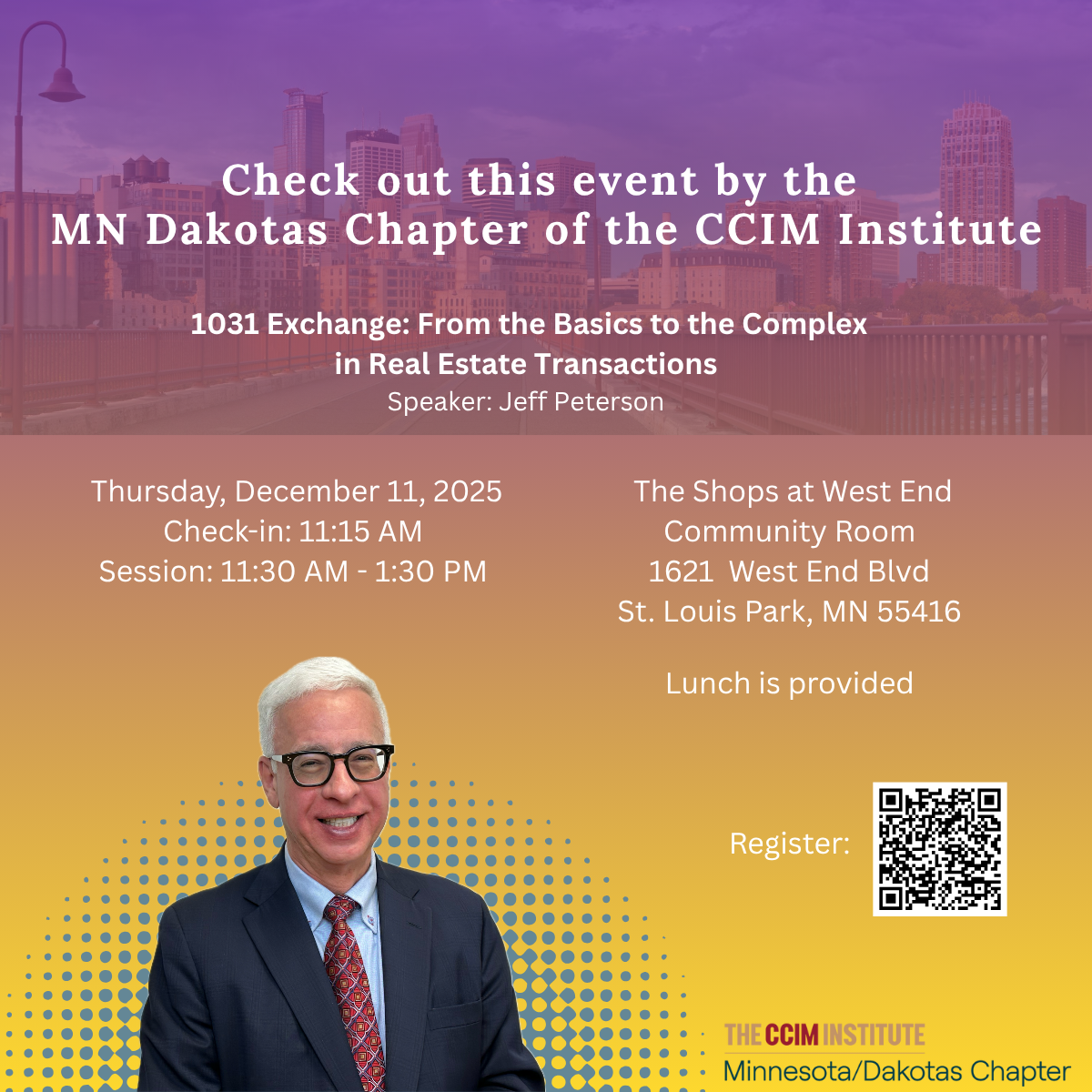

Presented by Jeffrey Peterson, President of CPEC1031

This program provides professionals with an understanding of I.R.C. Section 1031 Exchange rules, including foundational principles, real-world applications, and complex structuring scenarios. Topics include tax deferral theory, identification rules, related-party issues, drop & swap structures, and reverse exchanges.

At the end of the session, attendees will be able to:

Explain the key principles and historical context of I.R.C. Section 1031 exchanges

Identify the requirements for valid like-kind property and proper transaction structuring

Recognize timing rules, disqualifying situations, and common pitfalls

Understand complex strategies including reverse exchanges and drop & swap scenarios

2 hours of MN Real Estate CE applied for.

Event Details

Date: Thursday, December 11, 2025

Time: 11:30 AM – 1:30 PM

Location: The Shops at West End Community Room. 1621 West End Blvd, St. Louis Park, MN 55416

This is a lunch and learn event. Lunch will be provided. Please check in 15 minutes prior to the event to grab your lunch and be ready to learn.